jlpp.ru

Learn

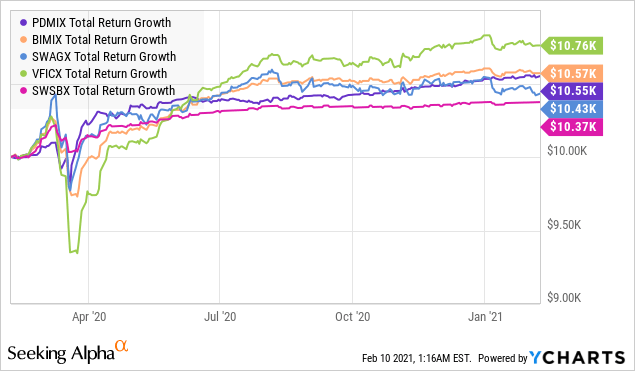

Best Retirement Funds To Invest In 2021

Four investment options for generating retirment income: Income annuity, a diversified bond portfolio, total return approach, and income-producing equities. CalSTRS is the largest educator-only pension fund in the world with assets totaling approximately $ billion as of July 31, . A mix of stocks, bonds, and cash investments that will work together to generate a steady stream of retirement income and future growth. funds support them as they save for retirement and education. These best wishes, and I hope that we in ICI Research will be able to see many of. In , state legislation established an In-State Investment program requiring a portion of Legacy Fund assets be invested in North Dakota. The Nuveen Lifecycle Index Retirement Fund has been structured to maximize risk-adjusted outcomes by investing in a portfolio of equity and bond index. Popular Fund Families · iShares · Fidelity Investments · Vanguard · T. Rowe Price · Charles Schwab · Principal Funds · AllianceBernstein · American Century Investments. BlackRock collectively supports millions of people around the world to make it easier and affordable to invest in resilient retirement plans. Explore more. The three retirement accounts you should aim to fill in · 1) Health Savings Account (HSA) · 2) (k) · 3) Roth IRA. Four investment options for generating retirment income: Income annuity, a diversified bond portfolio, total return approach, and income-producing equities. CalSTRS is the largest educator-only pension fund in the world with assets totaling approximately $ billion as of July 31, . A mix of stocks, bonds, and cash investments that will work together to generate a steady stream of retirement income and future growth. funds support them as they save for retirement and education. These best wishes, and I hope that we in ICI Research will be able to see many of. In , state legislation established an In-State Investment program requiring a portion of Legacy Fund assets be invested in North Dakota. The Nuveen Lifecycle Index Retirement Fund has been structured to maximize risk-adjusted outcomes by investing in a portfolio of equity and bond index. Popular Fund Families · iShares · Fidelity Investments · Vanguard · T. Rowe Price · Charles Schwab · Principal Funds · AllianceBernstein · American Century Investments. BlackRock collectively supports millions of people around the world to make it easier and affordable to invest in resilient retirement plans. Explore more. The three retirement accounts you should aim to fill in · 1) Health Savings Account (HSA) · 2) (k) · 3) Roth IRA.

Retirement income. Small & midsized retirement plans (plan assets Retirement plans · Advisor resources · Institutional Investing. Investment Only. Interim IRRs by themselves are not the best indicators of current or future fund performance. Greenleaf Co-Invest Partners, L.P., , $,, As a result, the ASRS investment goals are: Maximize the fund rate of return for acceptable levels of fund risk. Achieve a 75th percentile rate of return. Interim IRRs by themselves are not the best indicators of current or future fund performance. Greenleaf Co-Invest Partners, L.P., , $,, Each of the Target Retirement Funds invests in Vanguard's broadest index funds, giving you access to thousands of U.S. and international stocks and bonds. plan savings and their retirement income. Sponsors could encourage plan sponsors and consultants (March and March-April ). Percentages may. Climate change poses significant risks to the Common Retirement Fund's investments Progress Report on Climate Action Plan – April · Climate Action Plan. Top 25 Mutual Funds ; 1, VSMPX · Vanguard Total Stock Market Index Fund;Institutional Plus ; 2, FXAIX · Fidelity Index Fund ; 3, VFIAX · Vanguard Index. When you get investment recommendations on your retirement accounts, it is important to know whether the person giving you that advice is a “fiduciary” under. Maximum annual benefit can be up to $ ($, for ; $, for ; $,0and for ; $, for ). Contributions are. Fidelity ZERO Large Cap Index; Vanguard S&P ETF; SPDR S&P ETF Trust; iShares Core S&P ETF; Schwab S&P Index Fund; Shelton NASDAQ Index. (k)s let you set aside part of each paycheck into an account, where (depending on your plan options) you can invest in things like mutual funds and ETFs. In. Investment Options that correspond with the year closest to when you will be the target retirement age, defined as age Each Target Retirement Fund has a. Select an investment option that aligns with your investing personality (conservative, moderate, aggressive) or the year closest to when you hope to retire. In , retirement savers experienced a second Employers strive to drive plan value, and savers want to invest their retirement savings affordably. American Funds retirement income portfolios support different withdrawal needs while seeking to maintain a retiree's initial investment. Target-Date Funds: An Overview. Target retirement funds are designed to be the only investment vehicle that an investor uses to save for retirement. Also. TipCharts are best viewed in landscape. Please rotate your device. ×. Asset FY Performance and Asset Allocation Reports. September 30, The Nuveen Lifecycle Retirement Income Fund has been structured to maximize risk-adjusted outcomes by investing in a portfolio of equity, bond. Fidelity Investments and Morningstar Inc, (). Past performance Registered investment products (including mutual funds and ETFs) and collective.

What Cloud Computing Do

Cloud computing facilitates rapid deployment of applications and services, letting developers swiftly provision resources and test new ideas. This eliminates. Cloud computing is the delivery of computing services over the internet. Learn how it can lead to better innovation while saving you money. Cloud computing technology gives users access to storage, files, software, and servers through their internet-connected devices. Cloud computing offers companies convenient models to access infrastructure, platform, and software offerings on a pay-as-you-go basis. With cloud computing. What are the benefits of cloud computing? · Data is extremely accessible. Businesses use cloud computing to access information anywhere using an internet-. Cloud computing is the use of off-site systems to help computers store, manage, process, and/or communicate information. These off-site systems are hosted on. Cloud computing is the on-demand availability of computing resources (such as storage and infrastructure), as services over the internet. Cloud computing refers to the delivery of computing services like storage, servers, databases, networking, analytics, and more over the Internet. These. Cloud computing is the on-demand availability of computer system resources, especially data storage (cloud storage) and computing power, without direct active. Cloud computing facilitates rapid deployment of applications and services, letting developers swiftly provision resources and test new ideas. This eliminates. Cloud computing is the delivery of computing services over the internet. Learn how it can lead to better innovation while saving you money. Cloud computing technology gives users access to storage, files, software, and servers through their internet-connected devices. Cloud computing offers companies convenient models to access infrastructure, platform, and software offerings on a pay-as-you-go basis. With cloud computing. What are the benefits of cloud computing? · Data is extremely accessible. Businesses use cloud computing to access information anywhere using an internet-. Cloud computing is the use of off-site systems to help computers store, manage, process, and/or communicate information. These off-site systems are hosted on. Cloud computing is the on-demand availability of computing resources (such as storage and infrastructure), as services over the internet. Cloud computing refers to the delivery of computing services like storage, servers, databases, networking, analytics, and more over the Internet. These. Cloud computing is the on-demand availability of computer system resources, especially data storage (cloud storage) and computing power, without direct active.

Cloud computing is the use of remote servers hosted by third parties (instead of local servers or computers) to store, process, and manage data and perform. You can access data, applications, and computing resources from anywhere in the world, rather than needing to be connected to a computer in an office. As a. Via an Internet service connection, cloud storage works by enabling users access and to download data on any chosen device, such as a laptop, tablet or. How an organization handles and secures business assets and needs can be reflected in how it deploys its cloud service. But cloud deployment is more than just a. 9 Common Uses of Cloud Computing · 1. File storage · 2. Big Data Analytics · 3. Data backups and archiving · 4. Disaster recovery · 5. Software testing and. You can break cloud computation down into three different core functions: Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a. In the simplest terms, cloud computing means storing and accessing data and programs over the internet instead of your computer's hard drive. (The PCMag. Cloud computing is the collective name for the delivery of computing resources across the internet. Businesses using cloud technology benefit from the. Cloud computing is about hardware-based services (involving computing, network and storage capacities), where: Services are provided on-demand;. Simply put, cloud computing is a way of accessing services on the internet instead of on your computer. You can use the cloud to access applications, data, and. How does cloud computing work? Cloud computing orchestrates technology and infrastructure, offering unmatched flexibility and efficiency. Cloud computing. The primary benefit of cloud computing is that it comes with a pay-as-you-go pricing strategy. This means that you will not have to pay for unused time – saving. Cloud computing gives your business more flexibility. You can quickly scale resources and storage up to meet business demands without having to invest in. In a nutshell, cloud computing is the on-demand availability of computer system resources, especially data storage (cloud storage) and computing power, without. Every user and company will receive a unique set of advantages. The key element is to consider it in broad terms. Evaluate the potential savings. You can access data, applications, and computing resources from anywhere in the world, rather than needing to be connected to a computer in an office. As a. Cloud computing is the use of remote servers hosted by third parties (instead of local servers or computers) to store, process, and manage data and perform. Cloud computing is the delivery of computing resources — including storage, processing power, databases, networking, analytics, artificial intelligence, and. Cloud computing is a means of providing computing services (including databases, servers, software, and networking) via the internet. Cloud computing facilitates rapid deployment of applications and services, letting developers swiftly provision resources and test new ideas. This eliminates.

How Much Is Shiba

1 SHIB equals USD. The current value of 1 Shiba Inu is +% against the exchange rate to USD in the last 24 hours. The current Shiba Inu market. FXStreet used a variety of technical indicators to predict that the price of SHIB could appreciate as much as 10% in the coming months. It points out a small. The current price is $ per SHIB with a hour trading volume of $M. Currently, SHIBA INU is valued at % below its all time high of $ Shiba Inu (SHIB) is a meme coin that has seen a growth of % since its inception on Nov. 28, , and continues to be a hope for thousands of holders. Shiba Inu Historical Data ; Aug 27, , , ; Aug 26, , , ; Aug 25, , , ; Aug 24, $ - The price SHIB surpassed $ in October With a monumental price increase after its launch, many investors have been looking at the. Shiba Inu's price today is US$, with a hour trading volume of $ M. SHIB is % in the last 24 hours. It is currently % from its 7-day. Shiba Inu price depends on various factors such as lineage, sex, and types of registration. It is important to find a reputable AKC approved Shiba Inu. is $,, in the last 24 hours, representing a % decrease from one day ago and signalling a recent fall in market activity. 1 SHIB equals USD. The current value of 1 Shiba Inu is +% against the exchange rate to USD in the last 24 hours. The current Shiba Inu market. FXStreet used a variety of technical indicators to predict that the price of SHIB could appreciate as much as 10% in the coming months. It points out a small. The current price is $ per SHIB with a hour trading volume of $M. Currently, SHIBA INU is valued at % below its all time high of $ Shiba Inu (SHIB) is a meme coin that has seen a growth of % since its inception on Nov. 28, , and continues to be a hope for thousands of holders. Shiba Inu Historical Data ; Aug 27, , , ; Aug 26, , , ; Aug 25, , , ; Aug 24, $ - The price SHIB surpassed $ in October With a monumental price increase after its launch, many investors have been looking at the. Shiba Inu's price today is US$, with a hour trading volume of $ M. SHIB is % in the last 24 hours. It is currently % from its 7-day. Shiba Inu price depends on various factors such as lineage, sex, and types of registration. It is important to find a reputable AKC approved Shiba Inu. is $,, in the last 24 hours, representing a % decrease from one day ago and signalling a recent fall in market activity.

How it work. The 3Commas currency calculator allows you to convert a currency from Shiba Inu (SHIB) to US Dollar (USD) in just a few clicks at live exchange. Convert Shiba Inu (SHIB) to US Dollar (USD) with our instant cryptocurrency converter. SHIB is currently worth $ How much is 1 SHIBA INU in US Dollar? 1 SHIBA INU is US Dollar. So, you've converted 1 SHIBA INU to US Dollar. We used. Shiba Inu launched in July The first exchange rate of SHIB detected by our platform is $, the lowest price was $E-8 in March , and the. The live Shiba Inu price today is $ with a hour trading volume of $M. The table above accurately updates our SHIB price in real time. According to our records, it started trading on Monday, June 15th , for a first price of $ How volatile has Shiba Inu been over the last 30 days? SHIB ranks 16 by market cap. It has a 24H high of $ recorded on Sep 14, , and its 24H low so far is $, recorded on Sep 14, How to convert. Shiba Inu to United States Dollar ; Create your free. Kraken account. You can trade SHIB on Kraken with as little as $ ; Connect your funding. Shiba Inu Historical Data ; Aug 27, , , ; Aug 26, , , ; Aug 25, , , ; Aug 24, How much is 1 SHIBA INU in US Dollar? 1 SHIBA INU is US Dollar. So, you've converted 1 SHIBA INU to US Dollar. We used. The current Shiba Inu price is $ In the last 24 hours Shiba Inu price moved +%. The current SHIB to USD conversion rate is $ per SHIB. The price of Shiba Inu (SHIB) is $e-5 today, as of Sep 13 a.m., with a hour trading volume of $M. Over the last 24 hours, the price. The last known price of Shiba Inu is USD and is up over the last 24 hours. It is currently trading on active market(s) with $,, Convert 1 SHIBA INU to US Dollar with our real-time 1 SHIBA INU 1 SHIB to USD Calculator - How much US Dollar (USD) is 1 SHIBA INU (SHIB)? Shiba Inu USD (SHIB-USD) ; Aug 4, , , , , ; Aug 3, , , , , Big bettors toss tough questions at WazirX amid legal tangles · India leads in crypto adoption for second straight year, report shows · Crypto stocks fall as. Shiba Inu (SHIB) has a market cap of $ and a live price of $ Check more stats and compare it to other stocks and crypto. 1 SHIB to USD Calculator - How much US Dollar (USD) is 1 Shiba Inu (SHIB)? ; Exodus ; Coinrule ; Uphold ; Coinbase ; Chain GPT. The live price of SHIBA INU is $, with a total trading volume of $ M in the last 24 hours. The price of SHIBA INU changed by +% in the past. FXStreet used a variety of technical indicators to predict that the price of SHIB could appreciate as much as 10% in the coming months. It points out a small.

How To Get A Brand New Car

Reliability and warranty protection. Most new cars have good reliability records, and if anything goes wrong, it's probably covered by the manufacturer's. Register your new car, truck or motorcycle online without a DMV office visit! You can transfer existing license plates or get new plates in the mail. New Car Purchase Checklist · 1. Your Driver's License · 2. Proof of Insurance · 3. Form of Payment · 4. Recent Pay Stubs · 5. Recent Utility Bills · 6. Credit Score. Brand new cars can have higher insurance premiums than used cars. And if you live in a state with personal property taxes, the newer your car, the more you'll. 7 reasons to consider a new car · 1. Your lease is maturing · 2. You want to save money on costly maintenance and repairs · 3. You want to save money on gas · 4. As we alluded to earlier, it's ideal to start browsing for a new vehicle before you absolutely have to have one. This gives you ample time to do your research. Do your best to get to a ratio of 50 or higher, in other words, owning a home equal to 50 times or more the value of your car. Too many people are spending too. However, trading in a new vehicle may be a waste of money. The depreciation that occurs when you leave the dealership means your trade-in will have less value. New Cars - Looking to Buy a Brand New Car? Research and Compare New Car Models and Browse Thousands of New Cars for Sale at jlpp.ru Reliability and warranty protection. Most new cars have good reliability records, and if anything goes wrong, it's probably covered by the manufacturer's. Register your new car, truck or motorcycle online without a DMV office visit! You can transfer existing license plates or get new plates in the mail. New Car Purchase Checklist · 1. Your Driver's License · 2. Proof of Insurance · 3. Form of Payment · 4. Recent Pay Stubs · 5. Recent Utility Bills · 6. Credit Score. Brand new cars can have higher insurance premiums than used cars. And if you live in a state with personal property taxes, the newer your car, the more you'll. 7 reasons to consider a new car · 1. Your lease is maturing · 2. You want to save money on costly maintenance and repairs · 3. You want to save money on gas · 4. As we alluded to earlier, it's ideal to start browsing for a new vehicle before you absolutely have to have one. This gives you ample time to do your research. Do your best to get to a ratio of 50 or higher, in other words, owning a home equal to 50 times or more the value of your car. Too many people are spending too. However, trading in a new vehicle may be a waste of money. The depreciation that occurs when you leave the dealership means your trade-in will have less value. New Cars - Looking to Buy a Brand New Car? Research and Compare New Car Models and Browse Thousands of New Cars for Sale at jlpp.ru

In the market for a new car? Autoblog is a car buying site that lets you find new cars by make, model, trim, style, type and price to get all the new car. TrueCar lets you control your car-buying journey. Shop new & used cars, sell your car, and find all the vehicle information you need with our research. If the vehicle is new, a completed Application for Title or Registration (REG ) form. · If the vehicle is used, the California Certificate of Title (or an out. Reliability and warranty protection. Most new cars have good reliability records, and if anything goes wrong, it's probably covered by the manufacturer's. If you need to flog your current wheels, you've two options – either part-exchanging the car at the dealership, where the dealer gives you a price and knocks it. Get the latest news on investing, money, and more with our free newsletter. Submit. By subscribing, you agree to our. Buying a new car ensures you'll get the most possible life out of the car. You are the first owner, after all! With almost no miles, the most up-to-date. You've completed the process of buying a car and your brand new vehicle is finally on your driveway. But before climbing in, buckling up and hitting the gas. Make it clear you're willing to entertain the “old” car if they make the price less than a younger (a similar car that has spent very little time in inventory). Experience the ease of buying a car through Costco Auto Program. Browse new models and receive member-only savings when you buy or lease a new automobile. Here are Top 8 Benefits of Buying a Brand-new Car: 1. Reliability 2. Driving down costs 3. Design 4. Old versus New 5. Living with your new car. Find the perfect car for your needs at jlpp.ru Shop new and used cars, sell your car, compare prices, and explore financing options to find your dream car. Whether it's brand new or new to you, let's outline the best ways to get and save on auto insurance. Table of contents: auto insurance for a new car. What's the. Hottest New Cars and Trucks · Nissan Altima · Toyota Tundra CrewMax · GMC Yukon XL · Toyota Tundra Double Cab · Lincoln Navigator L · It's illegal to drive your new vehicle without registration. In some cases, you can register your new automobile and get permanent license plates at the. When purchasing a new vehicle, it is best to have the car delivered to your door directly from the factory. If that's not an option, ask the dealer not to. 1. Research the numbers · The trade-in value of your current vehicle: You can do this by visiting the industry guides above. · Any incentives you might qualify. But some dealerships may specify a nonrefundable deposit in exchange for selling you the vehicle at the window-sticker price. Make sure to get all the details. Whether you're buying a new car or a used car, a little research up front can help ensure that you get the best value for your money. Make sure to take your.

How To Do Catch Up On 401k

A catch-up contribution is an elective deferral made by a participant age 50 or older that exceeds a statutory limit, a plan-imposed limit, or the actual. Enter your (k) contributions using the method that best fits your situation. If you've set up your paycheck in Quicken, edit your paycheck to include the. To catch up on contributions, individuals must instruct their retirement account provider or employer's HR/benefits department, depending on the account type. Catch-up contributions can be made to traditional and Roth IRAs, as well as to (k) plans and certain other employer-sponsored retirement plans. But if you. A catch-up contribution is any elective deferral made by an eligible participant that is in excess of the statutory limit ($18, in ), an employer-imposed. Once you turn 50, you can use catch-up contributions to boost your retirement savings accounts—including your employer-sponsored (k) or a traditional or. To start, a catch up contribution is not something that you have to enabled. If you're eligible, your contribution limit will automatically be increased by the. Beginning in the calendar year in which you turn 50, you're allowed to make annual catch-up contributions to a (k) plan, provided you are eligible under the. The tax code provides “catch-up” savings opportunities so that people age 50 and older can increase their tax-advantaged contributions to IRAs, (k)s, and. A catch-up contribution is an elective deferral made by a participant age 50 or older that exceeds a statutory limit, a plan-imposed limit, or the actual. Enter your (k) contributions using the method that best fits your situation. If you've set up your paycheck in Quicken, edit your paycheck to include the. To catch up on contributions, individuals must instruct their retirement account provider or employer's HR/benefits department, depending on the account type. Catch-up contributions can be made to traditional and Roth IRAs, as well as to (k) plans and certain other employer-sponsored retirement plans. But if you. A catch-up contribution is any elective deferral made by an eligible participant that is in excess of the statutory limit ($18, in ), an employer-imposed. Once you turn 50, you can use catch-up contributions to boost your retirement savings accounts—including your employer-sponsored (k) or a traditional or. To start, a catch up contribution is not something that you have to enabled. If you're eligible, your contribution limit will automatically be increased by the. Beginning in the calendar year in which you turn 50, you're allowed to make annual catch-up contributions to a (k) plan, provided you are eligible under the. The tax code provides “catch-up” savings opportunities so that people age 50 and older can increase their tax-advantaged contributions to IRAs, (k)s, and.

To make catch-up contributions to a (k), you must be age 50 or older and enrolled in a plan that allows catch-up contributions, such as a (k). The clock. But to get the tax benefits of catch-up contributions, you'll need to raise your retirement plan savings rate. How to calculate your savings increase. Peggy. or an equivalent employer plan (such as a (k),. (b), or (k)(6) Contributions toward the catch-up limit do not count against the elective. For , the employee deferral limit is $23, For those 50 or older, the IRS allows ''catch-up'' contributions of up to $7,, for a total contribution of. First, you make after-tax contributions up to the annual maximum to the traditional IRA (make sure to file IRS Form every year you do this). Then, transfer. k employee contribution limits increase in to $ from $ In addition, those over 50 years of age can make additional catch-up contributions. Anyone can start making catch-up contributions at the beginning of the year in which they turn 50, provided their (k) plan allows for them. Fortunately. Catch-up contributions allow people aged 50 or older to make additional contributions on top of the annual deferral limit for all employer-sponsored retirement. Add the K Catch-up transaction type to the employee's record in Employee > Deduction and set the Yearly Limit to (see table above). Be sure to make the. Traditional (b) Catch-Up – If you are within the three years prior to your plan's Normal Retirement Age, you may be eligible to make a one-time election to. Plan participants utilizing catch-up contributions must be aged 50 or older by the last day of the year. · Most (k) plans allow for catch-up contributions. Under SECURE , if you are at least 50 years old and earned $, or more in the previous year, you can make catch-up contributions to your employer-. However, if you are 50 or over and have both an IRA and a k, you can save an additional $7, in For , the catch up contribution limits are as. If you are over 50, higher limits allow you to make "catch up" contributions. Get started on your (k) catch-up now to build bigger savings. Who is eligible to make a catch-up contribution? How many retirement plans offer this feature? Are we required to provide this additional elective deferral to. For (k) participants, the catch-up contribution limit is $7, for , on top of the annual $22, contribution limit. The catch-up contribution limit is. Catch-up contributions are salary deferrals (also referred to as “elective deferrals”) that employees age 50 or older can make in addition to their regular. Both catch-up contribution types can be used in the same taxable year if eligibility requirements for both are met. The lifetime catch-up may be available at. A catch-up contribution is any elective deferral made by an eligible participant that is in excess of the statutory limit ($18, in ), an employer-imposed. One important thing to remember is that you can only make an age catch-up contribution if your plan permits them. Over 90% of all plans allow catch-up.

Unit Investment Trusts Pros And Cons

Before you invest in a UIT, it's important to have a firm grasp of a trust's specific investment strategy or goal. UITs can invest in a wide variety of. What are collective investment trusts? Collective investment trusts (CITs) are pooled investment vehicles sponsored and maintained by a bank or trust. UITs offer the convenience and diversification of owning a portfolio of securities in a packaged investment with a stated investment objective. The factors to consider before investing in UIT are represented creatively. Using a few call-out boxes, you can illustrate how a UIT works. The pros and cons of. does not exist with unit trusts and OEICs, and that investment trust shares The AIC's web- site also contains a lot of useful information in this area. Pros. unit trust for purpose of investment gives pros and cons to investors. Additionally, jlpp.ru of UT · Unit Trusts Pros · Unit Trusts Cons · Should I. As for disadvantages? Perhaps the most obvious is that UITs are more or less fixed investments that do not change their investment mixes in an effort to adjust. Benefits and General Risks of Investing in Unit Trust Funds · Investing in a unit trust fund enables the investors to enjoy the benefits and advantage of. The pros of UIT investments include simplicity of investment, units' liquidity, diversification of securities, and low investment capital. Before you invest in a UIT, it's important to have a firm grasp of a trust's specific investment strategy or goal. UITs can invest in a wide variety of. What are collective investment trusts? Collective investment trusts (CITs) are pooled investment vehicles sponsored and maintained by a bank or trust. UITs offer the convenience and diversification of owning a portfolio of securities in a packaged investment with a stated investment objective. The factors to consider before investing in UIT are represented creatively. Using a few call-out boxes, you can illustrate how a UIT works. The pros and cons of. does not exist with unit trusts and OEICs, and that investment trust shares The AIC's web- site also contains a lot of useful information in this area. Pros. unit trust for purpose of investment gives pros and cons to investors. Additionally, jlpp.ru of UT · Unit Trusts Pros · Unit Trusts Cons · Should I. As for disadvantages? Perhaps the most obvious is that UITs are more or less fixed investments that do not change their investment mixes in an effort to adjust. Benefits and General Risks of Investing in Unit Trust Funds · Investing in a unit trust fund enables the investors to enjoy the benefits and advantage of. The pros of UIT investments include simplicity of investment, units' liquidity, diversification of securities, and low investment capital.

If you invest in a unit trust or fund, your money is pooled with money from other investors and invested in a portfolio of assets according to the fund's stated. Units, a collective investment trust or “CIT.” The Trustees elected to make this change after careful consideration and input from the Plan's Investment. Unit Trust · Easy to introduce new equity partners – no value shifting rules · Less regulations than a company · When non-related parties are in trust together. Advertised on an Initial Public Offering, or IPO, unit investment trusts invest in stocks, bonds, and other securities. One characteristic that makes them. investment adviser's services. Comparatively, there are pros and cons regarding a UIT's structure. These securities avoid management fees, which is a benefit. Pros and cons of investing in REITs · Compared to other investment types, REITs typically offer high dividend yields since they are required to distribute at. The disadvantages of unit investment trusts are the high fees. UITs are usually sold by brokerages, which charge a commission. There is often a front load. funds, collective investment trusts (CITs) and separate accounts Exhibit 1 advantages they may present compared to mutual funds. Pros and cons of CITs. Limitations of REITs ; Pros, Cons ; Liquidity, Lack of tax benefits ; Option to diversify, Market risk ; Transparent, Low growth prospect ; Risk-adjusted returns. Your resources are pooled with other investors, allowing you to make investments impossible as an individual investor. It helps you to easily diversify your. Slightly different rules. Unlike mutual funds, investment trusts can take on gearing, or borrowing additional money for investments, which unit trusts are not. Vulnerability to Betrayal: Trust can make individuals and organizations vulnerable to betrayal or breaches of trust. · Slow to Build, Quick to. To be a good investment, a UIT must meet your personal investment objectives and risk tolerance. You must also be comfortable with the UIT structure, which is. 2. Which is an advantage to the investor of a unit investment trust? · The value of the units rise at a fixed rate. · The units have a net asset value. · The fees. All unit investment trusts are passively managed. Remember that they have fixed portfolios. This means that their portfolios are not actively managed or. Overall, investment trusts can offer investors a range of benefits, but investors should carefully consider the potential disadvantages, such as limited gearing. investment manager. The mutual fund is set up either as a corporation or a unit trust (we will discuss the pros and cons of each legal structure in the next. Also, a UIT is free to hold only a handful of securities; most mutual funds are required to have far more individual holdings to achieve a. Not Suitable For Short-Term Investment Most of the unit trusts are not suitable for short term investment. That is what often touted by agents or principals.

Which Bank Is Better

Explore our expert-reviewed best national banks for superior financial services, secure online banking, and of course some great bank bonuses. Major national banks generally offer minuscule APYs compared to some of the top institutions on our list. For example, Bank of America, Chase Bank, and Wells. Rank 1: Union Bank & Trust; Rank 2: Cornhusker Bank; Rank 4: Cornerstone Bank; Rank 5: First National Bank of Omaha. Ohio: Rank 2: The Huntington National Bank. A personal banking experience designed with you in mind. If you're looking for a bank that's in harmony with your life, Umpqua has the tools to help you reach. Bank a Fifth Third Better®. We make it seamless, with no hidden fees, easy direct deposit switch and step-by-step setup in our app! Citizens Clearly Better Business Checking® has no minimum balance requirement and no monthly maintenance fee. Learn more and open a business checking. Use the Find A Better Bank search tool to compare different checking accounts, rates, fees, and more. Provides unbiased results in minutes. Earn interest on your checking account balances with the Better Interest Checking account offered by State Street Bank. Apply to open an account today! The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. Explore our expert-reviewed best national banks for superior financial services, secure online banking, and of course some great bank bonuses. Major national banks generally offer minuscule APYs compared to some of the top institutions on our list. For example, Bank of America, Chase Bank, and Wells. Rank 1: Union Bank & Trust; Rank 2: Cornhusker Bank; Rank 4: Cornerstone Bank; Rank 5: First National Bank of Omaha. Ohio: Rank 2: The Huntington National Bank. A personal banking experience designed with you in mind. If you're looking for a bank that's in harmony with your life, Umpqua has the tools to help you reach. Bank a Fifth Third Better®. We make it seamless, with no hidden fees, easy direct deposit switch and step-by-step setup in our app! Citizens Clearly Better Business Checking® has no minimum balance requirement and no monthly maintenance fee. Learn more and open a business checking. Use the Find A Better Bank search tool to compare different checking accounts, rates, fees, and more. Provides unbiased results in minutes. Earn interest on your checking account balances with the Better Interest Checking account offered by State Street Bank. Apply to open an account today! The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't.

Serving the following areas: · Talmer Bank And Trust · Talmer Bank And Trust · First Merit · Spirit of Texas Bank · American Momentum Bank. Bank. BBB Rating. Compare today's best high-yield savings account rates with our ranking of over national banks and credit unions. Today's top APY is % from Poppy. Sofi Bank offers the best high-yield savings account in , based on an industry-leading score of out of stars from the MarketWatch Guides team. Start Saving Smart Today Welcome to a better state of banking The best do their banking here, where your money works as hard as you do. World #1 Scottie. Top Savings Account Interest Rates · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One - Performance Savings · SoFi Checking and Savings. PlainsCapital Bank, one of the largest banks in Texas, offers leading services including personal banking, commercial banking, and wealth management. Best checking account bonuses · Chase (Private Client): $3, bonus · Citibank: Up to $1, bonus · Huntington National Bank: Up to $ bonus · BMO: Up to. Partners Bank Mobile App. Our mobile app saves you time and energy by allowing you to transfer funds between accounts, check balances, or view e-statements any. We are building a faster, quicker Bank. We want to become a better partner to governments, the private sector, and, ultimately, the people we serve. Evergreen Bank offers a generous % APY on its high-yield savings account, with a minimum deposit requirement of $ With no monthly fees and no minimum. When comparing credit cards, national banks dominate our list of best credit cards. Credit union cards tend to focus more on offering lower interest rates. The Big 4 US banks – JPMorgan Chase, Citi, Wells Fargo, Bank of America – pumped $ TRILLION INTO FOSSIL FUELS in from to alone. To be the bank of choice that helps our clients fulfill their dreams, passionately supports our communities, and invests in the growth and development of our. A bank may waive maintenance fees if you keep a set minimum balance in your account. The good news is that there are some free checking accounts and steps you. Bank better with Coastal Credit Union in North Carolina. Enjoy a variety of personal and business accounts, loans, mortgages, HELOCs and more. Join today. Learn about common fees banks charge to your account and discover tips you can use to avoid them altogether with this article by Better Money Habits. Find the best account for you · Most flexible banking options with check writing and digital payments · Standard bank account features – also great for college-. Discover Checking Account: Best Cash Back Debit Card · U.S. Bank: Best for Simple, Fee-Free Banking · SoFi Checking Account: Best High-Interest Checking · Axos. Check out our current savings and loan rates on Better Banks! Find rates for mortgages, auto loans, CDs and more.

Rates On 6 Month Cd

Premier Deposit Interest Rates ; Premier 6 month · Premier 6 Month Relationship CD · Premier 12 month ; % · % · % ; % · % · %. In depth view into US 6-Month CD Rate including historical data from to , charts and stats. Today's Standard Fixed Rate CDs ; 3 month · %. % ; 6 month · %. % ; 1 year · %. %. 6-Month CD. % APY*. Open an Account · 9-Month CD. % APY*. Open an Account · Month CD. % APY*. Open an Account · Month CD. % APY*. Open an. The interest rate for the 6-Month CD Special is % with a corresponding % APY*. The promotional rate is only valid during the initial term and does not. Earn More with our Promotional Rates. %. Annual Percentage Yield (APY). for a 4 month fixed rate CD Range from 6 months to 10 years. Withdrawals /. Compare rates on 6 month CDs from banks and credit unions. Use the filter box below to customize your results. Click here to read more about features and. CD Rates ; % · % · % · % ; % · % · % · %. 6-Month CD. % APY*. Open an Account · 9-Month CD. % APY*. Open an Account · Month CD. % APY*. Open an Account · Month CD. % APY*. Open an. Premier Deposit Interest Rates ; Premier 6 month · Premier 6 Month Relationship CD · Premier 12 month ; % · % · % ; % · % · %. In depth view into US 6-Month CD Rate including historical data from to , charts and stats. Today's Standard Fixed Rate CDs ; 3 month · %. % ; 6 month · %. % ; 1 year · %. %. 6-Month CD. % APY*. Open an Account · 9-Month CD. % APY*. Open an Account · Month CD. % APY*. Open an Account · Month CD. % APY*. Open an. The interest rate for the 6-Month CD Special is % with a corresponding % APY*. The promotional rate is only valid during the initial term and does not. Earn More with our Promotional Rates. %. Annual Percentage Yield (APY). for a 4 month fixed rate CD Range from 6 months to 10 years. Withdrawals /. Compare rates on 6 month CDs from banks and credit unions. Use the filter box below to customize your results. Click here to read more about features and. CD Rates ; % · % · % · % ; % · % · % · %. 6-Month CD. % APY*. Open an Account · 9-Month CD. % APY*. Open an Account · Month CD. % APY*. Open an Account · Month CD. % APY*. Open an.

If the term of the CD is 6 months to less than 24 months, then the early CD Text Message Program: Message and data rates may apply. For help call 1. rate of return on the money. Personal CDs. Compare Our Rates. Term. APY1. Open 3-month CD. %. Open Account · Open 6-month CD. %. Open Account · Open Compare the best 6-month CD rates · % APY: Western Alliance Bank CD · % APY: Quontic CD · % APY: Barclays Online CD · % APY: LendingClub CD · Certificate of Deposit (CD) offering a % APY has a term of 6 months and applies the simple interest method, with interest paid at maturity. CD offering a. % APY* · The Annual Percentage Yield (APY) is accurate as of 9/5/ · A minimum initial deposit of $1, is required to open the CD. · Penalty for early. Discover the best six-month CDs, with rates & examples. BMO Alto, Quontic and Marcus currently offer the highest rate at % APY, while Barclays offers. Use our free online CD calculator to see how your interest will grow with Ridgewood's CDs. ; 6 Month CD, $, %, % ; 9 Month CD, $, %, %. Let's examine a scenario involving DR Bank's highly competitive 6-month CD with a % APY (Annual Percentage Yield). CD Specials ; TERM, MINIMUM OPENING BALANCE, RATE ; 8-Month · CD Special», $, %1 APY ; Month · CD Special», $2,, %2 APY. Standard CDs · 6 Months, %, %. 12 Months, %, %. 18 Months, %, %. 24 Months, %, %. 36 Months, %, % ; Bump Rate CDs · The rate table above allows you to shop around for the best CD rates in the 6-month category and compare different features offered by various banks and credit. Apply for a Popular Direct CD today. ; 6 Months, %, % ; 12 Months, %, % ; 18 Months, %, % ; 24 Months, %, %. At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. Quontic's CDs shine with top rates across terms from six months to five years, and the opening minimum of $ is relatively low compared to other online banks. APY = Annual Percentage Yield. Rate = Dividend Rate. Rates shown are our best rates; are correct as of the effective date (06/04/24) shown and are subject. Certificate of Deposit (CD) offering a % APY has a term of 6 months and applies the simple interest method, with interest paid at maturity. CD offering. Your award-winning CD account awaits ; 6 Months open an account, %, % ; 12 Months open an account, %, % ; 18 Months open an account, %, %. Today's Standard Fixed Rate CDs ; 3 month · %. % ; 6 month · %. % ; 1 year · %. %. One of the best CD rates around, our % APY1 Certificate of Deposit is a safe investment with a fixed rate giving you a predictable return on your money! The Marcus 6-Month High-Yield CD rate is % Annual Percentage Yield. The Marcus 6-Month CD matures after 6 months and is the shortest term CD that Marcus.

Corporate Tax Structure

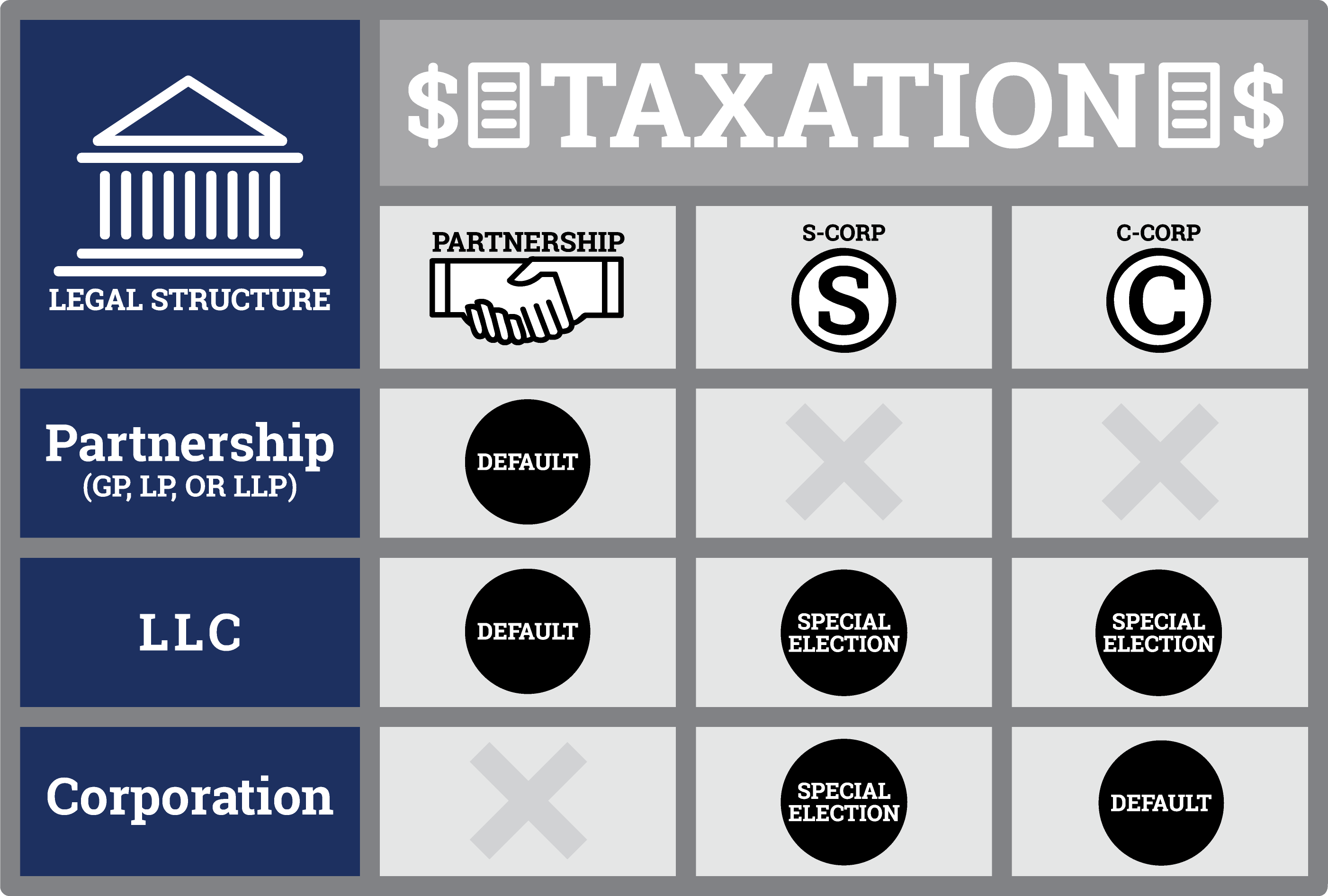

Generally, the liability of the members is limited to their investment and they may enjoy the pass-through tax treatment afforded to partners in a partnership. 2. Tax rules are based on your business structure · Sole proprietorship: A sole proprietor is someone who owns an unincorporated business by him or herself. CIT rates vary from state to state and generally range from 1% to 10% (although some states impose no income tax). The most common taxable base is federal. In either case it is still a corporate structure and the tax implications are the same. Your first reaction may be to figure out how to withdraw the funds from. Owners can split corporate profits among themselves and the corporation, paying lower overall tax rates. structural flexibility and favorable tax treatment. The TCJA, enacted in December , reduced the federal tax rate on corporations to 21 percent, a decrease of 14 percentage points from its previous level of The TCJA, enacted in December , reduced the federal tax rate on corporations to 21 percent, a decrease of 14 percentage points from its previous level of The Corporate Tax Rate in the United States stands at 21 percent. This page provides - United States Corporate Tax Rate - actual values, historical data. Corporate income tax (CIT) rates 22%, 25%, or 28%, depending on the company's shareholders structure (corporate structure) and disclosure compliance. Generally, the liability of the members is limited to their investment and they may enjoy the pass-through tax treatment afforded to partners in a partnership. 2. Tax rules are based on your business structure · Sole proprietorship: A sole proprietor is someone who owns an unincorporated business by him or herself. CIT rates vary from state to state and generally range from 1% to 10% (although some states impose no income tax). The most common taxable base is federal. In either case it is still a corporate structure and the tax implications are the same. Your first reaction may be to figure out how to withdraw the funds from. Owners can split corporate profits among themselves and the corporation, paying lower overall tax rates. structural flexibility and favorable tax treatment. The TCJA, enacted in December , reduced the federal tax rate on corporations to 21 percent, a decrease of 14 percentage points from its previous level of The TCJA, enacted in December , reduced the federal tax rate on corporations to 21 percent, a decrease of 14 percentage points from its previous level of The Corporate Tax Rate in the United States stands at 21 percent. This page provides - United States Corporate Tax Rate - actual values, historical data. Corporate income tax (CIT) rates 22%, 25%, or 28%, depending on the company's shareholders structure (corporate structure) and disclosure compliance.

Taxation – Some tax structures categorize their business income as personal income, while others tax business and personal income separately. Company hierarchy. How sole proprietorships, partnerships, LLCs, C corps, and S corps are taxed, and which business structure is right for your business. Business Tax. Overview. Generally, if you conduct business within any county and/or incorporated municipality in Tennessee, and your business grosses $, A C corp is a separate tax status, with income and expenses taxed to the corporation. If corporate profits are then distributed to owners as dividends, owners. The federal corporate tax rate in the United States is 21%, and it applies to a corporation's profits. The taxes are paid on a company's taxable income. This creates a double tax. Although owners pay a double tax on business earnings, Corporations can deduct certain benefits they provide to employees, such as. Information on personal and corporate income tax in the Yukon. Includes child benefit program and tax credits for small business investment, First Nations. Corporate tax is levied on the income earned by companies at a rate varying between %, depending on the companies' particulars. Corporate Income Tax (CIT) Rate. Your company is taxed at a flat rate of 17% of its chargeable income. This applies to both local and foreign companies. CIT. You pay Corporation Tax at the rates that applied in your company's accounting period for Corporation Tax. If your company made more than £, profit. Starting in , corporations that derive receipts of $1 million or more are also subject to tax. The new tax is being referred to as the business corporation. Since January 1, , the nominal federal corporate tax rate in the United States of America is a flat 21% following the passage of the Tax Cuts and Jobs Act. Instead, all of the business assets and liabilities and income are treated as belonging directly to the business owner. General partnership tax considerations. Corporate tax is levied on the income earned by companies at a rate varying between %, depending on the companies' particulars. The IRS refers to LLCs as "pass-through entities," which simply means that the tax liabilities of the company "pass through" to you and your co-owners personal. Business tax structure in Washington State. Washington State does not have a corporate or personal income tax. However, Washington businesses generally are. Business tax structure in Washington State. Washington State does not have a corporate or personal income tax. However, Washington businesses generally are. business assets, and it provides the greatest flexibility available when it comes to taxation and business structure. An LLC is the most common choice for. LLCs are popular for good reason. LLCs combine the liability protections of corporations with the pass-through taxation available to sole proprietors and. The current general corporate income tax rate is 12% and only 2% for small businesses. Taxation of investment income applies at the same general corporate.

To Sell On Craigslist

I've developed a keen sense of how to buy and sell through Craigslist, and I share some of my insights and tips below. How to Sell Your Stuff Successfully on Craigslist: 7 Tips · 7 Tips to Sell Successfully on Craigslist · 1. Post a Winning Photo · 2. Tailor Your Title · 3. Craigslist is a pain in the rear. ALWAYS screen via call before you deal. If you don't like person on call. You're gut is probably right to. I used this method to sell stuff on Craigslist — and Facebook Marketplace — for about a year or so. I laid out things probably oh, two to three times a week. To get started, go to jlpp.ru in your web browser, then locate and select post to classifieds. Clicking Post to Classifieds. Select the type of. In this comprehensive guide, you'll find tips and guidelines that'll come in handy when you start selling on Craigslist. Sign in to your craigslist account and click on what city you want to post on then click on create a posting. Then click on for sale by owner. Create a business by buying and reselling Craigslist deals. This article will show you how to sell on Craigslist so that you can make money fast! craigslist provides local classifieds and forums for jobs, housing, for sale, services, local community, and events. I've developed a keen sense of how to buy and sell through Craigslist, and I share some of my insights and tips below. How to Sell Your Stuff Successfully on Craigslist: 7 Tips · 7 Tips to Sell Successfully on Craigslist · 1. Post a Winning Photo · 2. Tailor Your Title · 3. Craigslist is a pain in the rear. ALWAYS screen via call before you deal. If you don't like person on call. You're gut is probably right to. I used this method to sell stuff on Craigslist — and Facebook Marketplace — for about a year or so. I laid out things probably oh, two to three times a week. To get started, go to jlpp.ru in your web browser, then locate and select post to classifieds. Clicking Post to Classifieds. Select the type of. In this comprehensive guide, you'll find tips and guidelines that'll come in handy when you start selling on Craigslist. Sign in to your craigslist account and click on what city you want to post on then click on create a posting. Then click on for sale by owner. Create a business by buying and reselling Craigslist deals. This article will show you how to sell on Craigslist so that you can make money fast! craigslist provides local classifieds and forums for jobs, housing, for sale, services, local community, and events.

In this article, we will inform you fully about this purchasing platform, from the definition, the price to the guide and the best tips to successfully sell on. Our seven Craigslist precautions will help prepare you for your first transaction 1. Always use a proxy email address or phone number 2. Plan details in. Sites like eBay, Craigslist, and Amazon are great for clearing out clutter and pocketing some cash in the process. 1. Visit jlpp.ru 2. Select the state you live in. 3. Click "post to classifieds". 4. Click "for sale by owner". 5. Select a category that best describes. List of all international jlpp.ru online classifieds sites. Craigslist is a pain in the rear. ALWAYS screen via call before you deal. If you don't like person on call. You're gut is probably right to. Looking for a business for sale on Craigslist? Check out this Exit Oasis story about how I sold my business with a free ad. Buy, sell, work, hire, rent, share, meet, learn, serve, fall in love, and/or save the world. Founded All the basics are on craigslist: jobs, housing. eBay and Craigslist are two online selling platforms that allow you to sell stuff you no longer use and make money. We're going to start this list off with the potential downsides to selling your car on Craigslist, then show you how to do it right if you still want to give. I have a few items I wan to sell, it not sure eBay is worth the time for a few items. Any body have experience selling through Craigslist. I. Run a quick search for similar items on Craigslist and these other used marketplaces to get a sense for pricing and availability. CL · about >. help. craigslist help pages. posting · searching · account · safety · billing · legal · FAQ. © craigslistCL; help · safety · privacy. 1. Open a Web browser and navigate to jlpp.ru Click the "My Account" link, followed by the "Sign up for an account" link. CL · about >. help. craigslist help pages. posting · searching · account · safety · billing · legal · FAQ. © craigslistCL; help · safety · privacy. craigslist: The original online classifieds. Buy, sell, work, hire, rent, share, meet, learn, serve, fall in love, and/or save the world. Founded To Sell Your Car on Craigslist is Free. Selling a car on Craigslist is free for individual users and people looking to buy whatever they desire. Business are. Craigslist serves a variety of purposes, one of which is a virtual market, where users can offer items for sale. Creating an ad on the site to sell. Our seven Craigslist precautions will help prepare you for your first transaction 1. Always use a proxy email address or phone number 2. Plan details in. It's as simple as posting a free listing for the item(s) you are trying to sell, and then waiting for the responses to come flooding in. The hardest part for.

1 2 3 4 5